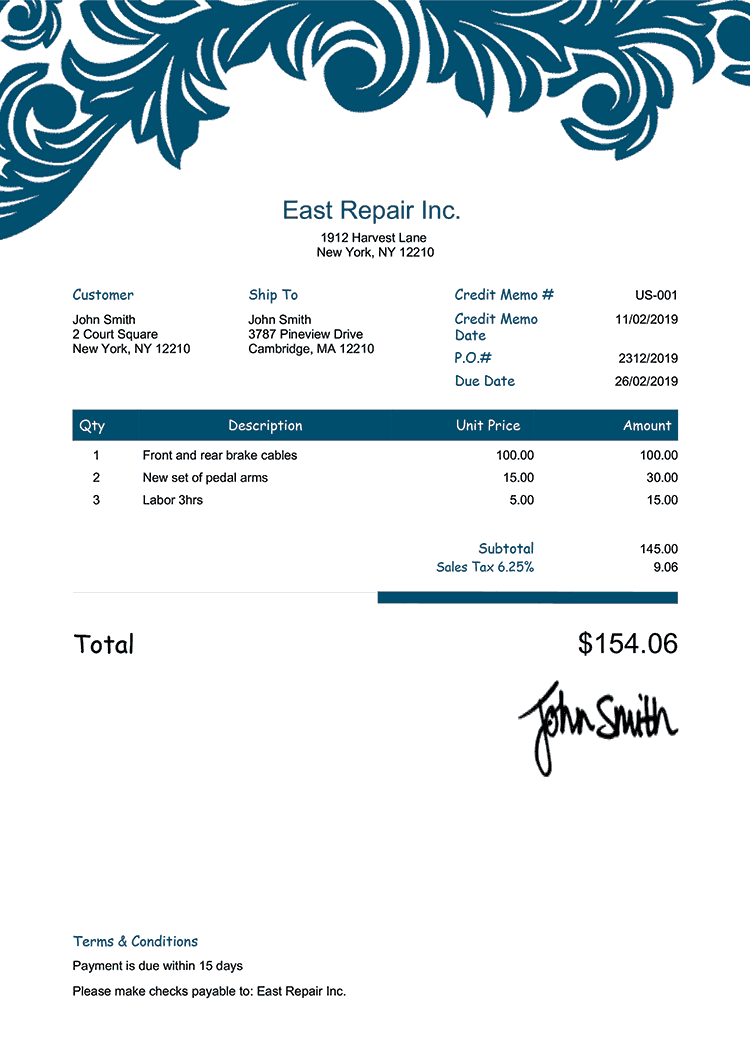

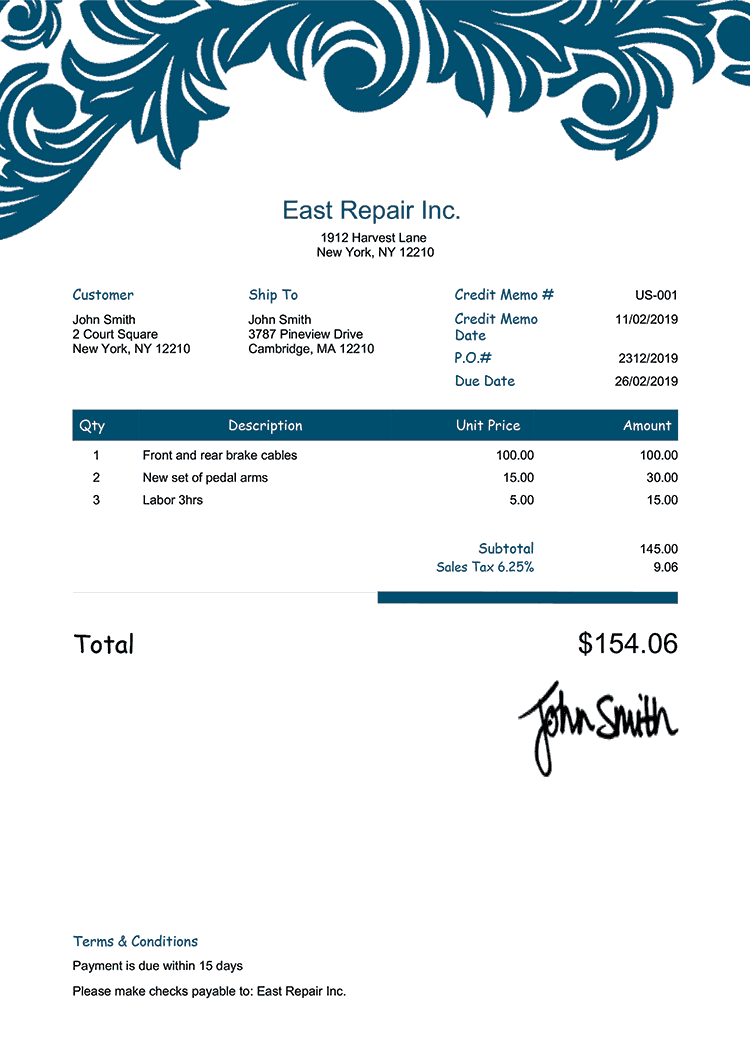

The Purpose of Corporate Governance Defined. Key Component of AML (Anti Money Laundering) Compliance Program. System and Organization Controls (SOC 1, SOC 2 & SOC 3) Reporting. SSARS Resources, Statement on Standards, Compilation and Review. Forensic Audit Definition, Example and Investigations. What Do You Mean By Earnings Before Interest and Taxes(EBIT). What Is Form 1099-C: Cancellation of Debt. What Are SOX 404 top–down risk assessment (TDRA)?. About Form 1099-C, Cancellation of Debt. What are cyber currency or Cryptocurrency?. This document also includes the reason for issuing the credit memo. All of this information helps a seller to keep track of inventory. The shipping address, a list of items, prices, quantities, and the date of purchase are other significant pieces of data found on a credit memo. Most credit memos feature the purchase order (or PO) number, as well as the terms of payment and billing. Types of Information on a Credit MemoĪ credit memo contains several pieces of important information. To record the bank credit memo the company will debit Cash and credit another account. Since the amount of the bank’s credit memo has already been added to the bank’s balance, the bank reconciliation will not reconcile unless the amount is also included in the company’s general ledger Cash account. The bank adding interest that was earned for having money on deposit, The bank having collected a note for the company and A refund of a previous bank charge are the examples of Bank Credit Memo in a Bank Reconciliation.

Credit Memos from the BankĪ bank credit memo is an item on a company’s bank account statement that increases a company’s checking account balance.

If this is allowed by the accounting software, it reduces the aggregate dollar amount of invoices outstanding, and can be used to reduce payments to suppliers. The seller should always review its open credit memos at the end of each reporting period to see if they can be linked to open accounts receivable. Seller company will then issue a credit memo for $4. Buyer company informs Seller company that one of the units is defective. Example of a Credit MemoĪssume that Seller Company had issued a sales invoice for $400 for 50 units of product that it shipped to Buyer Company at a price of $4 each. The credit memo usually includes details of exactly why the amount stated on the memo has been issued, which can be used later to aggregate information about credit memos to determine why the seller is issuing them. One type of credit memo is issued by a seller in order to reduce the amount that a customer owes from a previously issued sales invoice. A credit memo or credit memorandum is a document issued by the seller of goods or services to the buyer, reducing the amount that the buyer owes to the seller under the terms of an earlier invoice.

0 kommentar(er)

0 kommentar(er)