#Stock srdx how to

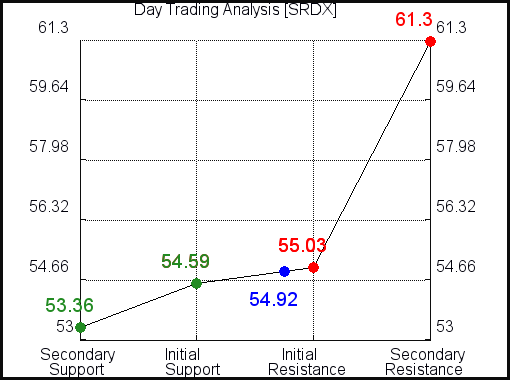

Statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat,Ĭlick here for more on how to use these ratings. The high in the last 52 weeks of SurModics stock was 61.35. Companies with ratings are not formally covered by a Morningstar analyst, but are

Peer companies that do receive analyst-driven ratings. The stock touched a low price of 0.6295.

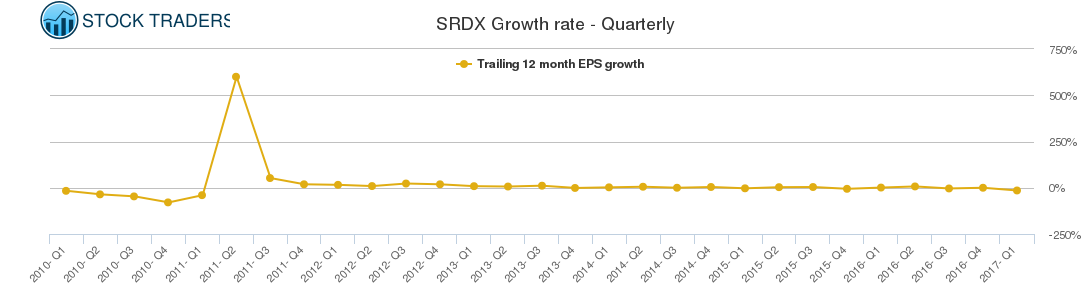

At the very opening of the session, the stock price was 0.638 and reached a high price of 0.718, prior to closing the session it reached the value of 0.64. A quarter ago, it was expected that this drug. (ARDX) is priced at 0.70 after the most recent trading session. This quarterly report represents an earnings surprise of 31.25. These figures are adjusted for non-recurring items. This compares to earnings of 0.62 per share a year ago. Morningstar Quantitative ratings for equities (denoted on this page by ) are generated using an algorithm that compares companies that are not under analyst coverage to SurModics (SRDX) came out with a quarterly loss of 0.22 per share versus the Zacks Consensus Estimate of a loss of 0.32. Is Surmodics (NASDAQ:SRDX) a buy Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing and company.

#Stock srdx code

Davidson is guided by Morningstar, Inc.'s Code of EthicsĪnd Personal Securities Trading Policy in carrying out his responsibilities. Is responsible for overseeing the methodology that supports the quantitative fair value. Use of the Service is not permitted if you are located in or are a resident or citizen of the United Kingdom of Great Britain. Lee Davidson, Head of Quantitative Research for Morningstar, Inc., Stocks rally as market attempts comeback from April sell-off: S&P 500 up 2.4, Dow gains nearly 600 points, Nasdaq climbs 2. Stocks SRDX (SRDX ) Stock quotes (SRDX) for today. There is no one analyst in which a Quantitative Star Rating and Fair Value Estimate isĪttributed to however, Mr.

0 kommentar(er)

0 kommentar(er)